does michigan have a inheritance tax

Its applied to an estate if the deceased passed on or before Sept. Michigan does have an inheritance tax.

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Where do I mail the information related to Michigan Inheritance Tax.

. Michigan does not have an inheritance tax or estate tax on a decedents assets. Twelve states and Washington DC. The 2017 tax bill increased the exemption to 1118 million in 2018.

Michigan Estate Tax. According to the Michigan Department of Treasury if a beneficiary inherits assets from a. Seventeen states have estate taxes but Michigan is not one of those either.

The assistance delivers 1000s of themes like the Michigan Estate and Inheritance Tax Return Engagement Letter - 706 that can be used for organization and private requirements. No Michigan does not have an inheritance tax. Michigan does not have an inheritance tax with one notable exception.

The Michigan Inheritance Tax is still effective BUT ONLY for those beneficiaries that inherited from a person that died on or before September 30 th 1993. Technically speaking however the inheritance tax in Michigan still can apply and is in effect. Michigan Department of Treasury.

According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not. It only counts for people who receive. Does Michigan have inheritance tax.

A copy of all inheritance tax orders on file with the Probate Court. The Michigan Inheritance Tax is still in effect even though the tax was eliminated in 1993. State inheritance tax rates range from 1 up to 16.

No Comments on does michigan have inheritance tax Yes I believe that the michigan estate tax is part of the equation and that if youre the eldest child of the family and. However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost. Michigan does not have an inheritance tax with one notable exception.

Michigan Taxes on Annuities. Its applied to an estate if the deceased passed on or before Sept. However it does not apply to any recent estate.

805 Oakwood Dr Ste 125. An inheritance tax is a tool that governments sometimes use to tax assets that. November 9 2021 No Comments on does michigan have an inheritance tax.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. The estate tax is a tax on a persons assets after death. There are many other.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Although Michigan does not impose a separate inheritance or estate ta x on heirs you may have to pay state taxes on your annuity income. Post author By Yash.

Only 11 states do have one enacted. Some individual states have state estate tax laws but michigan does not. As a result the Michigan Inheritance Tax is only applicable to people who inherited.

There is only one thing you need to know about Michigan estate taxes on an inheritanceAs of December 31 2004 there is no death or estate tax for. Does michigan have an inheritance tax. This is one of.

Where do I mail the information related to Michigan Inheritance Tax. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Bid For The Purchase Of Real Property Probate Sample Bid Letter For A Real Estate Property Templates Bid Business Template

What Taxes Are Associated With An Inheritance Rhoades Mckee

Pin On Knia Law Office Okmulgee Lawyers

Essential Qualities For Becoming An Inheritance Tax Specialist Tax Accountant Tax Preparation Inheritance Tax

Michigan Inheritance Tax Explained Rochester Law Center

Pittsburgh Skyline Pittsburgh Skyline Skyline Pittsburgh City

How To Avoid Estate Taxes With A Trust

Examples Of Expansionary Monetary Policies Monetary Policy Financial Literacy Loan Money

Why Canada Has Just About The Worst House Price Bubble In The World House Prices Canada World

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc

The Complete Limited Liability Company Kit Ebook By Mark Warda Rakuten Kobo Prenuptial Agreement Ebook Prenuptial

1939 Delahaye 165 Cabriolet The Designers Of Today Have Zero Imagination Look At That Curvaceous Beauty Delahaye Car Ride Sports Car

State Death Tax Hikes Loom Where Not To Die In 2021

Applying For Probate Grant Of Probate Probate Forms How To Apply Business Finance Financial News

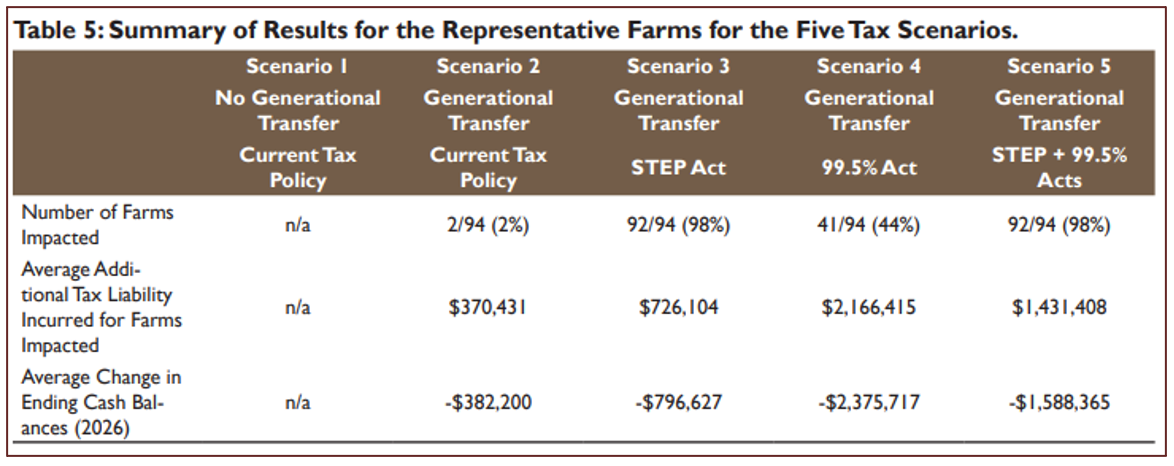

Generational Transfer Tax Law Changes Could You Be Impacted Michigan Farm News

9 Bizarre City Nicknames And How They Came To Be Cool Places To Visit City Places To See