how to lower property taxes in florida

097 of home value Tax amount varies by county The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. While you wont be able to contest the tax rate you will be able to submit a tax appeal to the assessors office to have your propertys value reassessed.

Florida Property Tax Consulting Firm Property Tax Consulant Tax Consulting Property Tax Consulting Firms

Let Mary King and Her Team Help with Your Florida Property Tax Matters.

. Be there when the county assessor performs the assessment. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. What can I do to my properties in Florida.

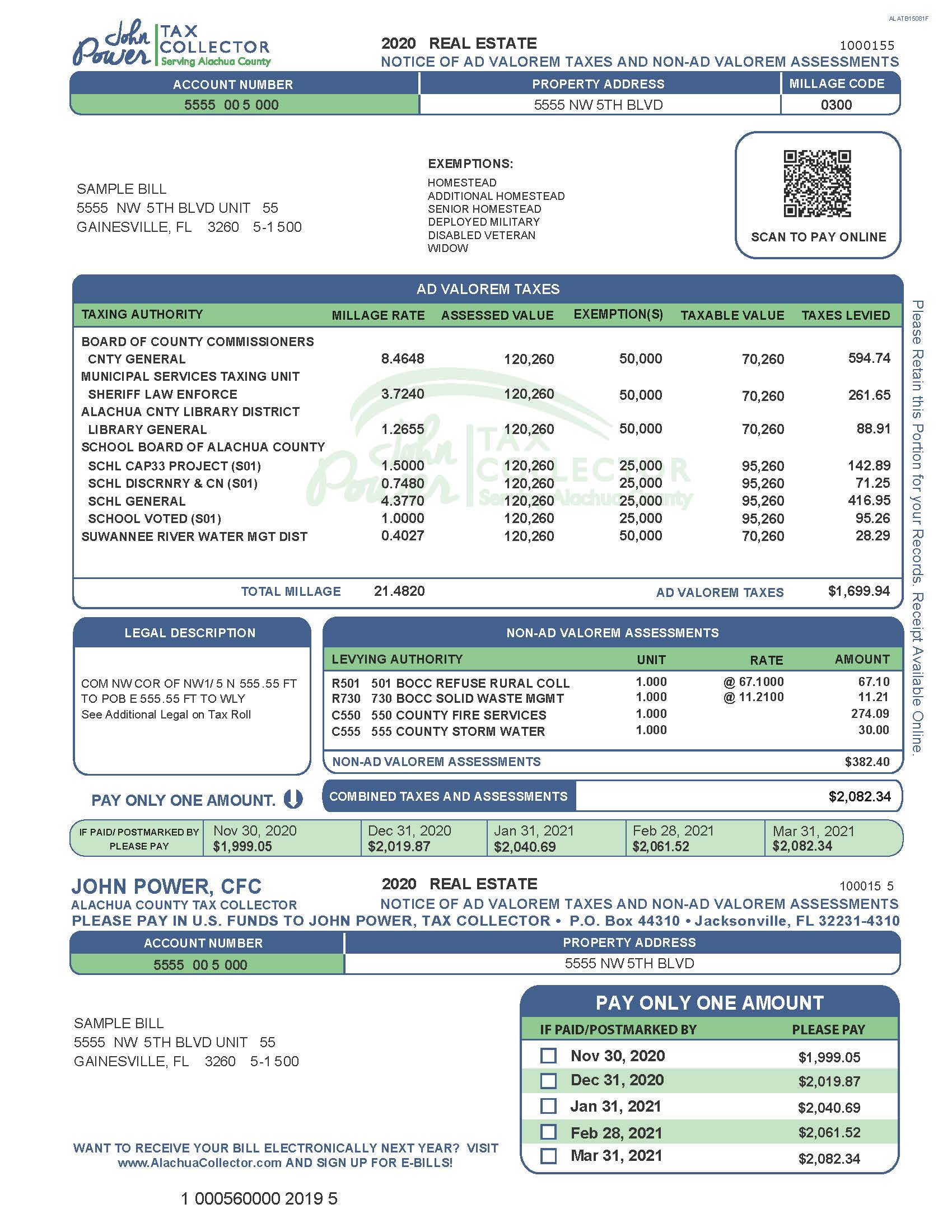

The state of Florida offers an informational guide that can provide more detail on this process and the exemption rules. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the propertys taxable value by as much as 50000. Check your property tax bill thoroughly for accuracy.

A tax appeal is the last resort for homeowners who want to lower their property taxes. King we understand the need for lower property taxes. 7 mins read How Can I Minimize My Property Taxes In Florida.

Use the drop-down menu to visit your county property appraisers website. File a Tax Appeal. There are a few other exemptions that you might be able to select if one or some of the following conditions apply.

They review and apply exemptions assessment limitations and classifications that may reduce your propertys taxable value. You can lower your propertys price by making sure its initial valuation remains lowMake sure to file your homestead benefit application in order to claim your tax refundThe 3rd tip for reducing tax penalties is to ensure the use of lots of PortabilityIf something is not right with your IT immediately request IT fixed. It frees the first 25000 of the homes assessed value from all property taxes and it exempts another 25000 from non-school property taxes.

In Florida all counties must keep records of all existing properties. Tax Collector Tax collectors send tax bills collect payments approve deferrals and sell tax certificates on properties with delinquent taxes. If youre lucky your tax assessor will agree.

Lets say you have a home with an assessed value of 80000. Reduce Your Property Taxes. According to ITEPs Who Pays the lowest-income 20 percent of Florida households spend 87 percent of their income on sales and excise taxes compared to just 09 percent of income spent on these taxes by the top 1 percent.

With this additional exemption here are some examples of how your taxable value can be reduced significantly. Floridas upside-down tax system is pushing the states impoverished taxpayers deeper into poverty. The most significant potential exemption is the homestead exemption which could save you up to 15 on property taxes if you own your home in Florida and it is your primary residence.

At the Law Offices of Mary E. We live at a time where saving every little bit matters. There are a few other things you can do to lower your property tax bill or get help paying your property tax in Florida.

You might also qualify for a property tax exemption if you are a deployed member of the military a widow or widower or if you are over the age of 65. The first 25000 would be exempt from all property taxes. Feasible Options to Reduce Your Property Taxes in Florida 1- Look at Real Property Information in Detail.

Miami-Dade County commissioners on Tuesday endorsed rate cuts on four property taxes for the first time in 10 years voting to set a rate ceiling thats 1 lower than current levels. So if you need expert legal guidance regarding your property taxes please dont hesitate to contact us today. For example imagine that the tax appraiser has placed a taxable value of 200000 on the Petersons home.

Lowest Property Tax Highest Property Tax No Tax Data Florida Property Taxes Go To Different State 177300 Avg. Florida authorities compute your property tax by multiplying your homes taxable value by the applicable tax rate. This can get confusing so heres an example.

This can decrease the taxable value of your property by up to 50000 depending on the specifics of your situation. If you are not sure I recommend that you either apply in person or call the Leon County Property Appraisers Office 850-606-6200 to clarify. If those two figures dont line up you should be able to reduce the assessmentand pay less.

Low Income Senior Exemption. So if your property is assessed at 300000 and. This exemption qualifies the home for the Save Our Homes assessment limitation.

Avoid any renovations or improvement work that could increase the value of your property.

Florida Real Estate Taxes And Their Implications

A Guide To Your Property Tax Bill Alachua County Tax Collector

Ponte Vedra Real Estate Ponte Vedra Florida Pontevedra North City

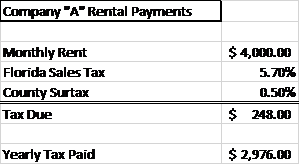

How To Calculate Fl Sales Tax On Rent

Florida Real Estate Taxes What You Need To Know

Lower Your Property Taxes Property Tax Tax Property

Your Guide To Prorated Taxes In A Real Estate Transaction

How Can I Minimize My Property Taxes In Florida Florida Homestead Check

Real Estate Property Tax Constitutional Tax Collector

What Is Florida County Tangible Personal Property Tax

How Can I Minimize My Property Taxes In Florida Florida Homestead Check

Protect Your Property From Creditors And Reduce Your Property Taxes Using Florida S Homestead Exemption